100+

Years Of Experience

Fixed Asset Data Management

Accurate, Robust Valuations

Fixed assets form a significant part of a company’s financial foundation. These tangible assets, ranging from property and equipment to machinery and infrastructure, are essential for sustained operations and long-term growth. However, managing and valuing fixed assets can be a complex and challenging task.

Fixed Asset Data Management encompasses the systematic organisation, verification and analysis of a company’s asset information. As experts in this field, Mitchell and Taylor Valuations offer invaluable services to businesses seeking to optimise their asset management processes. Our process involves accurate valuations, meticulous asset tracking and comprehensive reporting, providing businesses with the essential data-driven insights required to make informed financial decisions and ensure regulatory compliance.

Transactions, Mergers & Acquisitions.

Accounting, Tax & Stamp Duties.

Insurance, Risk Management & Legal.

Asset Based Lending.

Business Restructuring, Insolvency & Disposals.

Valuation Solutions

Data Management

Fixed Asset Register Verification

Since the early 1980’s the valuation team at Mitchell & Taylor have resolved our clients’ financial reporting issues by physically verifying and cleansing historic fixed asset register (FAR) data for businesses throughout all industry groups.

Our clients’ concerns revolved around the accuracy of the historic FAR data to provide current and reliable financial information. Their concerns included:

does any data inaccuracy cause the misstatement of carrying values for financial reporting ?

inaccuracies in forecasting sustaining capex due to understated/overstated yearly depreciation ?

is the business making a sufficient return on its capital investment ?

can management identify and optimise unused capacity in its asset base ?

is the yearly maintenance budget adequate to sustain the remaining useful lives of our assets ?

can we easily identify clear and concise data for under-performing assets for carrying value write-downs ?

can we easily identify clear and concise data for retired, sold, stolen or lost assets ?

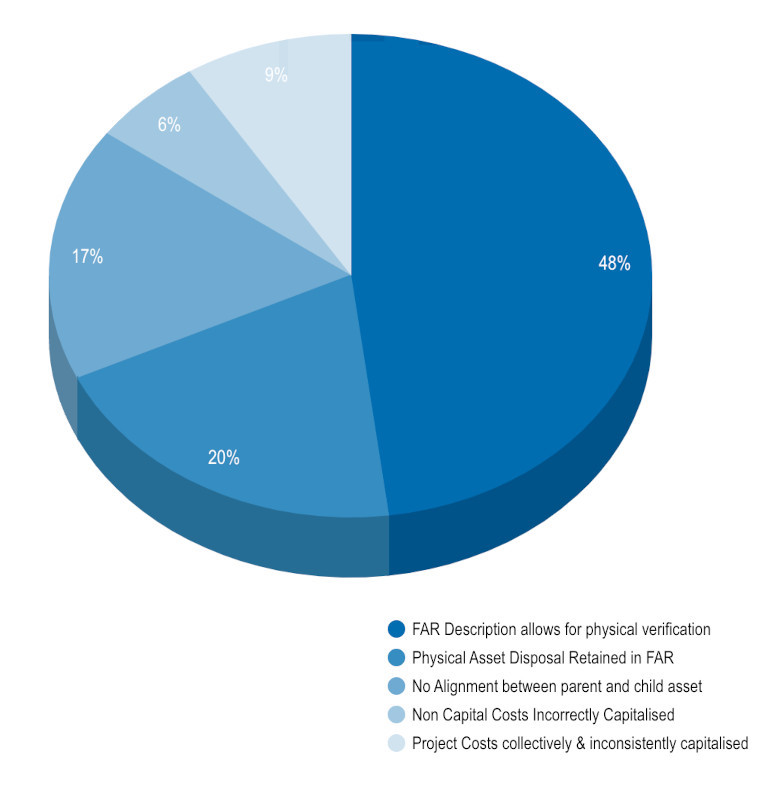

Mitchell and Taylor’s analysis has revealed that a typical unverified client FAR has a 52% data inaccuracy factor pre-verification and data cleansing

Project Cost Allocation

We play a critical role in accurately and fairly distributing the costs of a project among its various components. This process involves determining the value of individual assets, resources and expenses that contribute to the project’s overall cost. As valuation experts, Mitchell and Taylor Valuations, utilise their extensive knowledge and expertise to perform comprehensive assessments of these elements.

Our team collaborates closely with project managers and financial teams to understand the project’s scope, objectives, and resource allocation. They then conduct meticulous valuations of tangible and intangible assets, such as equipment, land, intellectual property, and human resources, while considering factors like depreciation, useful life, and market value.

By employing robust valuation methodologies, we ensure that project costs are accurately allocated, avoiding any overestimation or underestimation that could lead to financial imbalances or project delays. This not only enhances cost control and budgeting but also helps in making informed decisions on resource allocation and potential risks.

Furthermore, a valuation company’s involvement ensures transparency and compliance with accounting standards, enabling businesses to demonstrate the legitimacy of project costs to stakeholders, investors, and regulatory authorities. Overall, their expertise ensures that project cost allocation is fair, precise, and conducive to the project’s successful execution and financial viability.

Asset Register Establishment

Mitchell & Taylor’s valuers have undertaken major greenfield and brownfield capital cost allocation projects. Each of these projects involved:

the physical identification of all assets and the creation of a new fixed asset register

a total useful life estimate for each asset for tax and accounting depreciation

an overall project cost apportionment based upon the dissemination of invoices, capital expenditure requests and cost research

specific projects required each asset was attached with a unique barcode

The projects realised the following benefits for our clients:

The allocation of the total costs to individual assets for adoption of the accounting standard AASB 116 Property, Plant and Equipment

Future cost savings associated with undertaking regular asset stocktakes

Accounting and tax depreciation was accurately measured through the independent determination of a total useful life for each asset

The establishment of consistent and accurate asset data with a link to the physical asset through a unique barcode

Enhanced asset identification for the allocation of future sustaining capex and for the future recognition of specific asset disposals or write-offs